1. Trends in the installation market

Long-term market trends lead to new technologies, legislation and strong consolidation movement

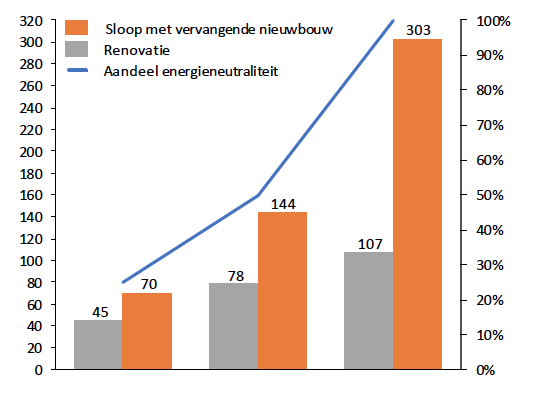

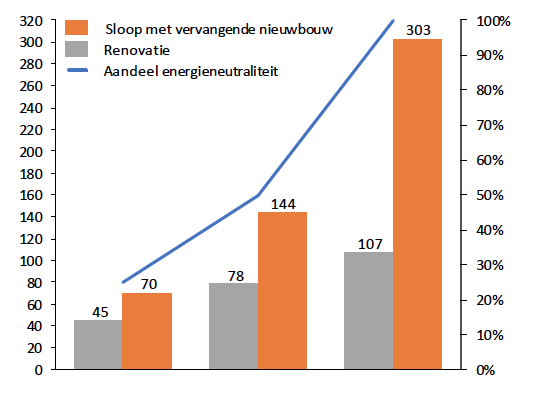

- Making buildings more sustainable is necessary because a significant portion of the Netherlands' CO2 emissions come from existing real estate. The EIB has calculated the investments needed to make the entire Dutch housing stock sustainable to energy-neutral homes. Part of this is the heat transition, the transition from the use of natural gas to sustainable alternatives for heating. This provides a lot of work for installers in the field of heat pumps and other sustainable heating solutions

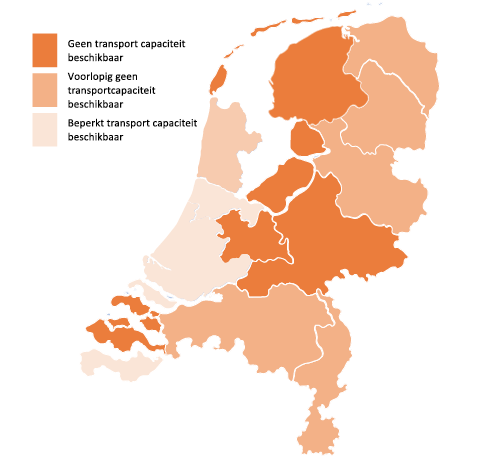

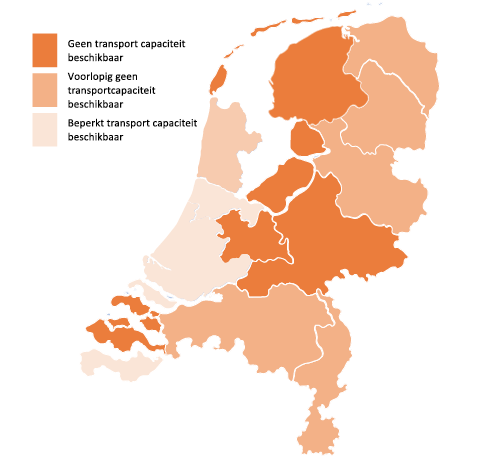

- Grid issues combined with forced electrification will create a new segment of installation work in storage systems, both in the residential and business customer segments

- Smart products and technologies are increasingly being installed to monitor plant maintenance or manage energy supply and consumption. Intelligence is needed to achieve rate-, need- and availability-driven charging and discharging of batteries

- Labor market tightnessis felt throughout the sector. Through (re)training and the influx of new personnel, attempts are being made to partially alleviate the shortage. Despite these efforts, the shortage will increase in the coming years

- Decision-making processes are changing. As installation work becomes more complex and a larger part of the total, installers are becoming involved earlier in the process on client projects. This requires early coordination in integrated teams

- Prefabrication of products and materials to achieve more efficient operational execution and cost efficiency

- Intensify chain collaborations with fellow installers, subcontractors and suppliers to work together efficiently and provide optimal customer service

- Consolidating installation market due to strong demand for installation work, fueled by the trend toward sustainability. At the same time, however, companies are experiencing challenges because they do not always have sufficient capital to keep up with developments and training, thus losing competitive advantage

- Legislation increases pressure for minimum energy efficient installations and building plans that developers and housing associations, among others, must comply with and from which a sustainability agenda is developed

Net congestion Netherlands (decrease map)

Source: Netbeheer Nederland

Cumulative Investment for climate-neutral housing stock (in € billion)

Source: EIB, Climate policy and the built environment

2. Stable installation market

Weakening growth is not disrupting the merger and acquisition market for now

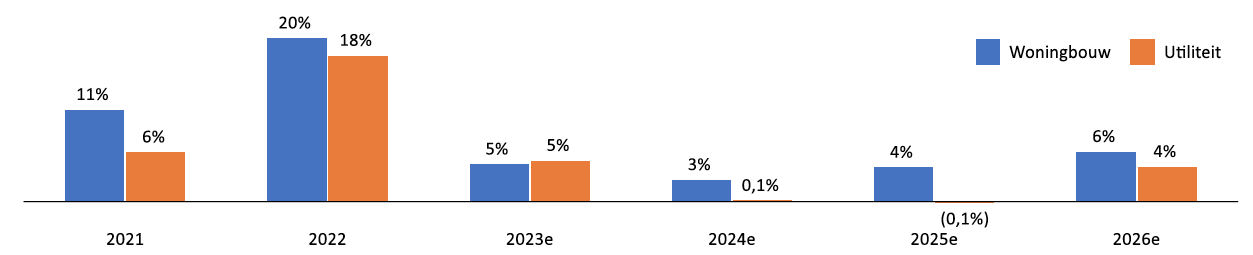

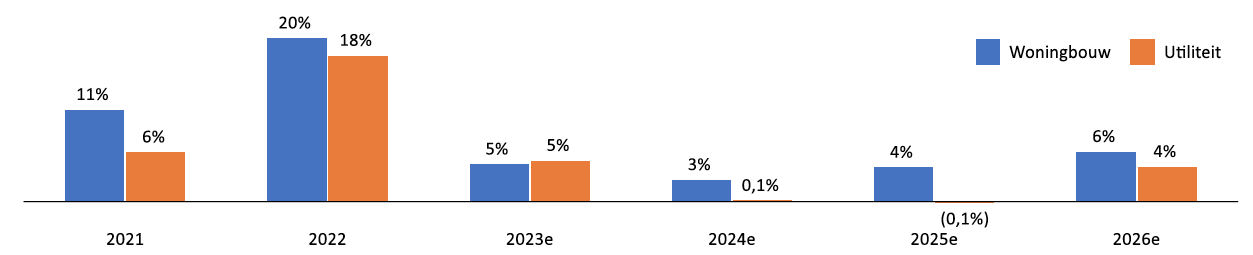

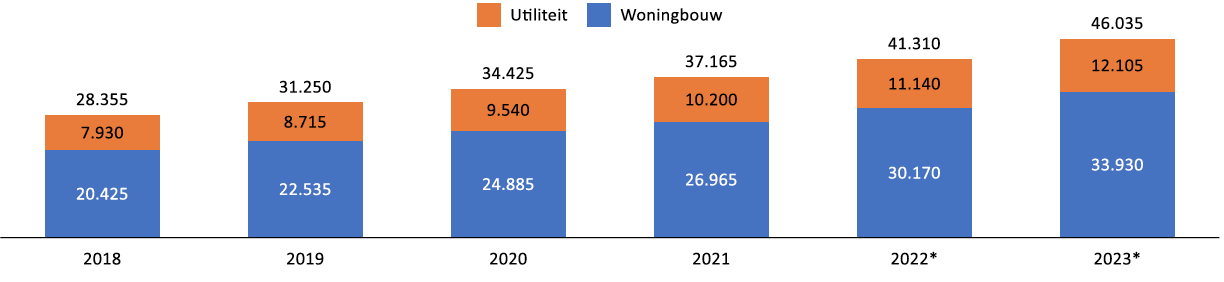

Nominal growth in the installation market will stagnate in the coming years.

- The total installation market (residential and non-residential) is expected to grow at an annual rate of about 3% from 2022 until 2026. Here the growth is expected to continue after 2026 due to the imbalance between the supply of skilled workers and the demand for installation work

- Therefore, the current size of the installation market and its expected future growth make it an attractive market to invest in

The expected nominal growth of the S&E installation market

Source: JBR analysis; calculation is real production volumes * construction cost inflation and its source: EIB, Bouwkennis, Techniek Nederland, CBS and BBN

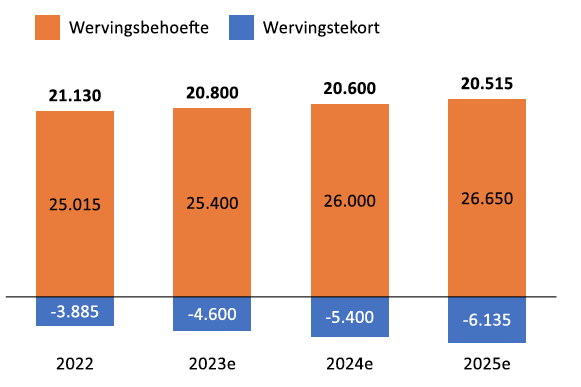

Despite stagnation, merger & acquisition market is expected to remain intact, due to high workload and labor market tightness.

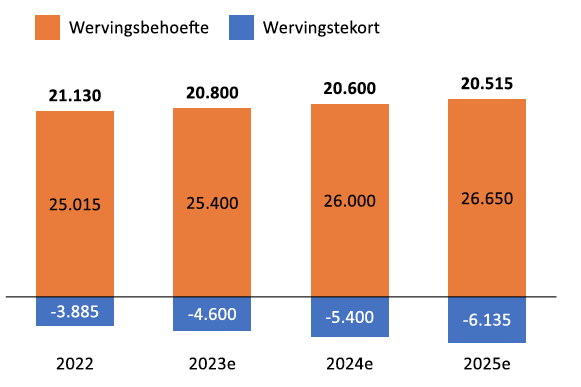

- With labor market shortages, companies will be less successful in meeting their hiring needs. Mainly because the greatest recruitment need is for mechanics. This accounts for roughly 60 percent of the installation labor market. Over the next four years, the shortage will increase by more than six thousand workers, on top of already existing shortages. This imbalance between labor supply and demand results in higher hourly rates and the need to acquire industry peers to expand the workforce

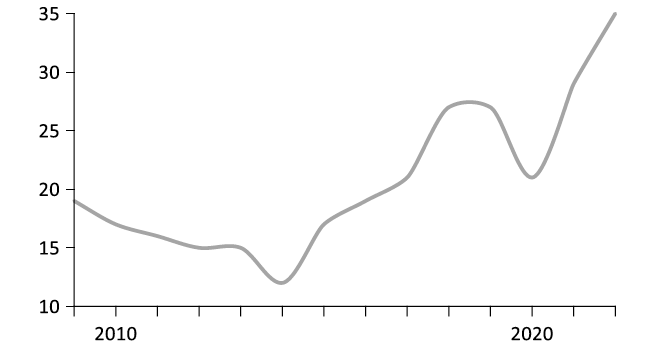

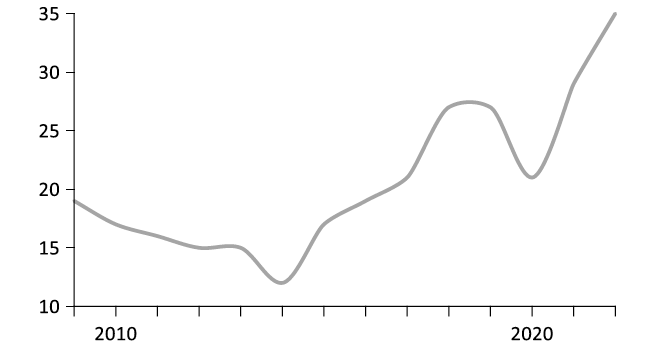

- Since its lowest point in 2014, the work inventory has been increasing at an average annual rate of 14%. Combined with labor market tightness, installers are forced to turn down work. However, growth is expected to stagnate in 2024 and 2025. The damage will be limited because there is enough work and the backlog can be cleared. After 2025, the outlook is better again in terms of growth as the energy transition gains momentum. The robust flow of future work encourages companies to make acquisitions, with the aim of expanding their customer base, order portfolio and service portfolio, thereby reducing their dependence

Work stock in weeks (mid-2022)

Source: Wij Techniek, Cobouw

Labor market tightness (in number per year)

Source: KBA Nijmegen & Wij-Techniek

3. Activity in the installation market

Strong growth in mergers & acquisitions requires alertness from both established and new players

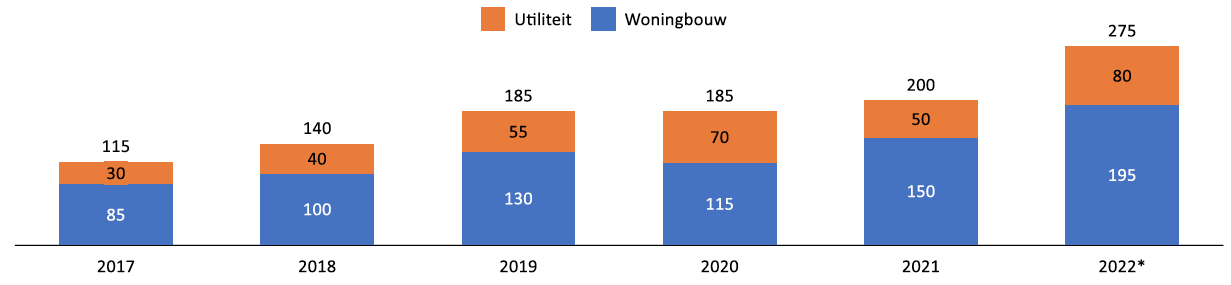

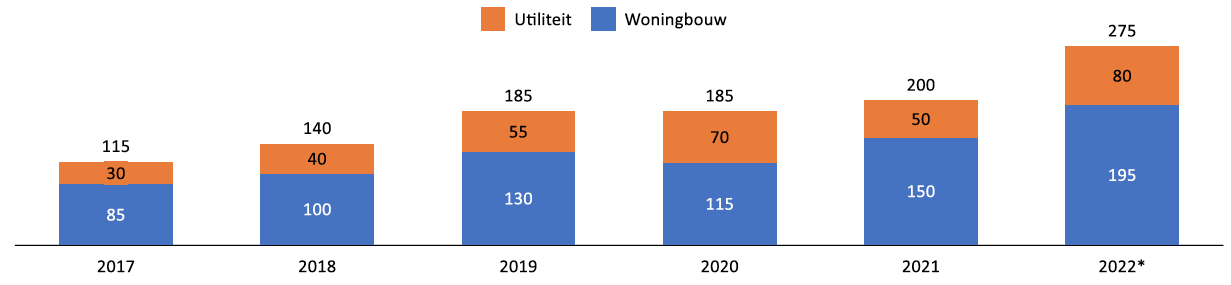

The number of mergers & acquisitions underscores the attractiveness of the installation market.

- The increasing number of mergers and acquisitions in the installation industry underscores its attractiveness as an investment market. Despite COVID-19, this sector is showing an annual growth rate of about 19% in acquisitions and mergers. This trend is largely driven by the growing demand for installation services and technologies in various sectors, such as construction, energy and infrastructureBusinesses in the installation market are looking for opportunities to expand their portfolio and strengthen and/or maintain their position in the market. Strategic acquisitions allow them to acquire new technologies and expertise, increase their customer base and gain access to new marketsThe distribution of mergers and acquisitions in the installation market shows reasonable similarity with the distribution of the number of companies by segment in this sector

Number of mergers and acquisitions in the installation market

Source: CBS StatLine

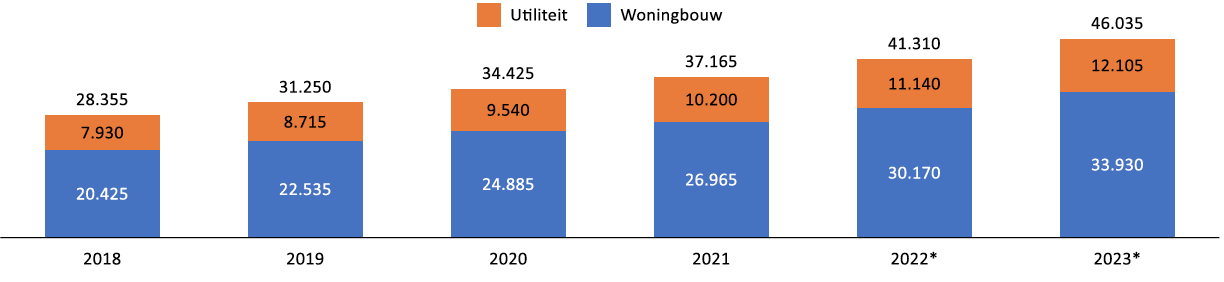

Due to the attractiveness of the installation market, entrepreneurs are starting their own installation companies.

- The number of companies in the installation market continues to grow steadily at about 10% per year. This trend can be attributed to an increasing number of installers choosing to establish their own installation companies. At the beginning of 2023, there were about 14% more companies with 0 to 5 employees than at the beginning of 2022 (30,805 compared to 26,990), which is even an increase of 76% compared to the beginning of 2018

- New players need to be alert to capitalize on opportunities in this dynamic market and also experience the same challenges (such as labor market tightness) as incumbents

- Entrepreneurship is not for everyone, so the number of new ventures remains somewhat limited. The distinctiveness of new entrants results in adaptation of innovation, which makes these companies attractive for acquisition

Number of companies in the installation market

Source: CBS StatLine

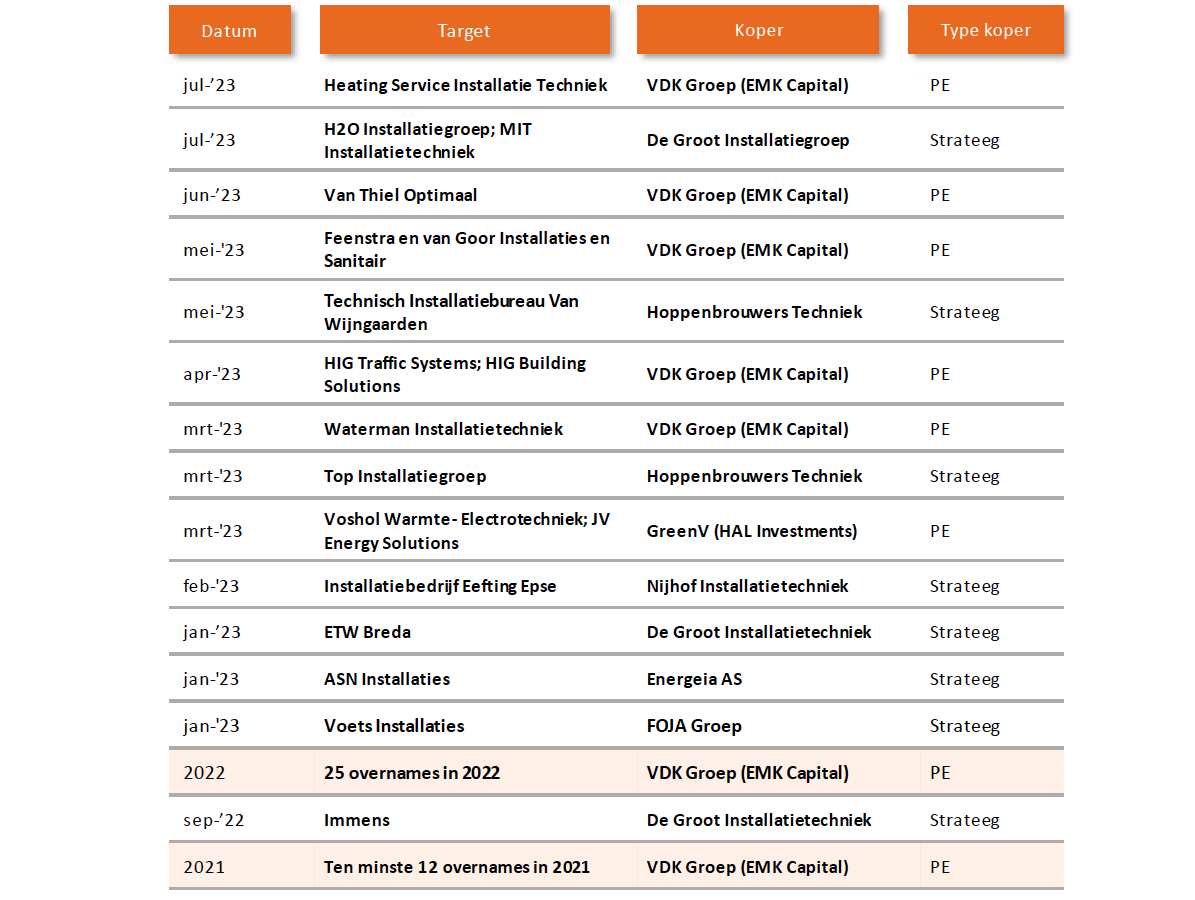

4. Overview of recent transactions and reasons for acquisitions

Potential buyers see opportunities in installation market to execute buy-and-build strategy

For both strategists and financial buyers, the following considerations come into play.

- Create scalability in work areas by efficiently deploying employees. Acquisition of other parties creates the opportunity to acquire more staff in current or adjacent work areas. The installation market is still a particularly fragmented market in which various economies of scale can be realized

- Create scalability in purchasing by collectively purchasing larger quantities of materials from wholesalers and importers allowing purchasing advantages to be realized

- Broaden service offerings to act as a one-stop shop so that larger customers can purchase all services from one party, which the market is increasingly moving toward

- Automation and digitization of maintenance services to minimize overhead

- Sharing and exchanging expertise on internal business processes as well as in maintenance and improvement works and centralizing functions such as finance, business development, ICT, HR, branding and legal issues combined with offering a wide range of specialties that are complementary, creating win-win/cross-fertilization

- Multiple arbitrage: by buying up smaller lots and combining them as larger lots, the overall valuation grows

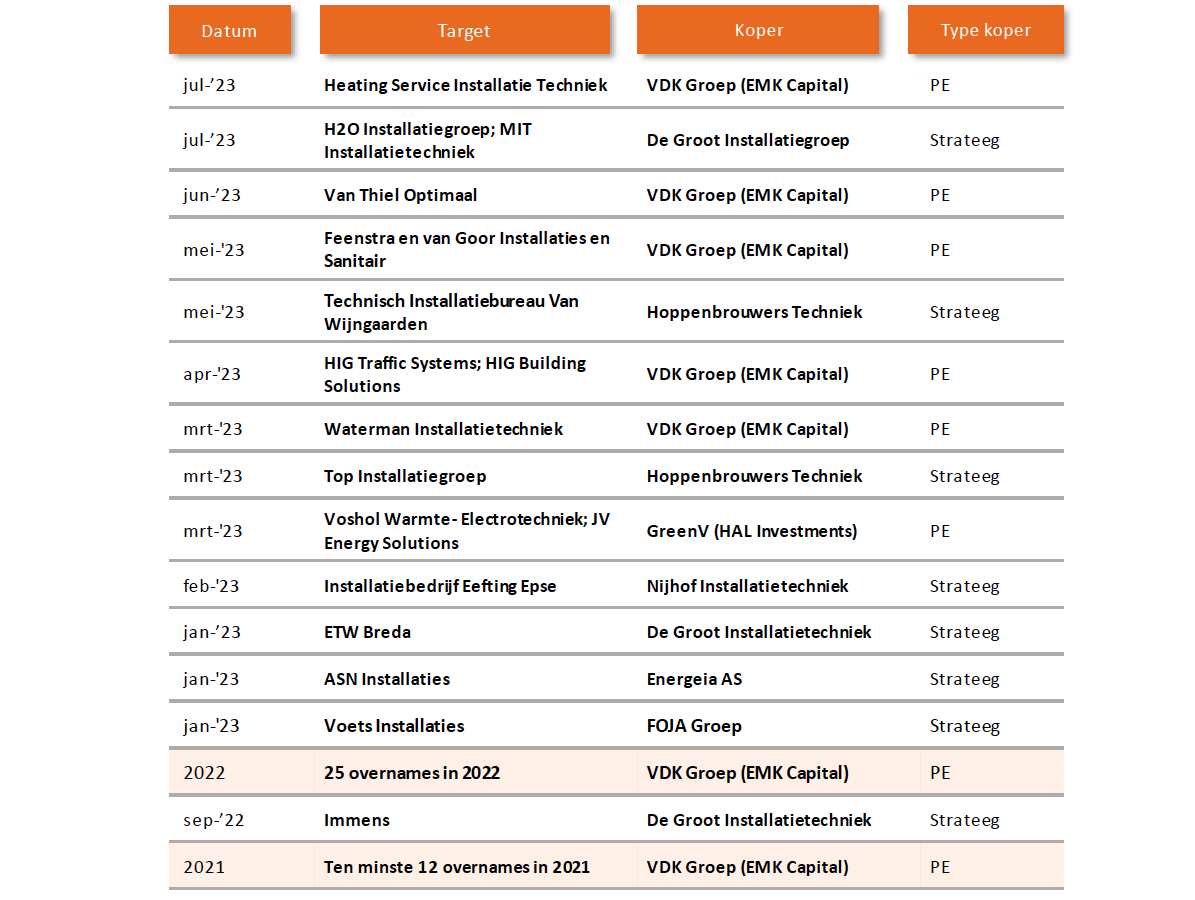

Overview of some recent transactions. PE stands for Private Equity, also known as investment companies*

Source: JBR analysis

*The transactions of VDK for 2021 and 2022 are combined in this overview for the sake of clarity and marked with this color:

5. Business valuation

Valuation within the installation market is highly dependent on turnover, type of work, project control, commerciality and degree of digitalization of the company

The multiple range depends on the following factors:

- The size of the organization in turnover, labor capacity and quality

- The type of work (plumbing, air conditioning or electrical) where the ability to work in series and the degree of complexity of the work determines efficiency and scalability

- The degree of commerciality of the organization which greatly affects the level of gross margin. This is partly determined by pre-calculation capacity and purchasing power. Bidding too sharply for work puts pressure on margins.

- The degree of direction on project administration, monitoring project progress and making timely adjustments

- Automating and digitizing processes around maintenance. The more digitized the less indirect costs need to be incurred. Example: automating invoicing after maintenance work leads to fewer (personnel) costs for administration and a significantly lower working capital requirement

- The level of operating margin which is also partly determined by the level of involvement in the construction team and logistics arrangement

- The degree of central management of the organization, this relates to possible bids for projects and being able to offer work centrally

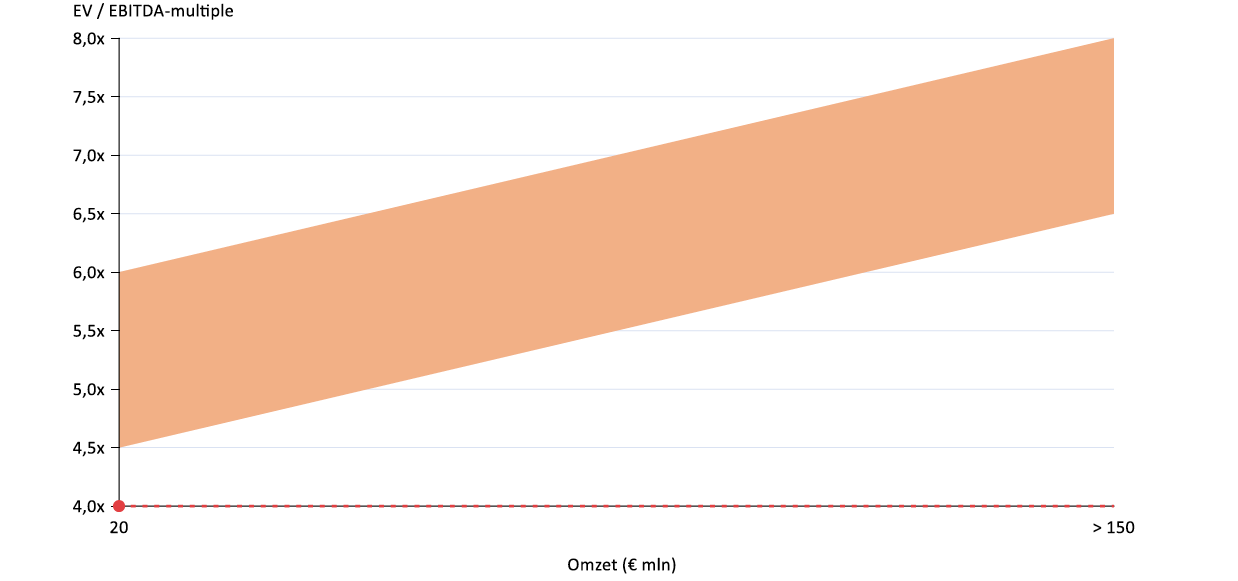

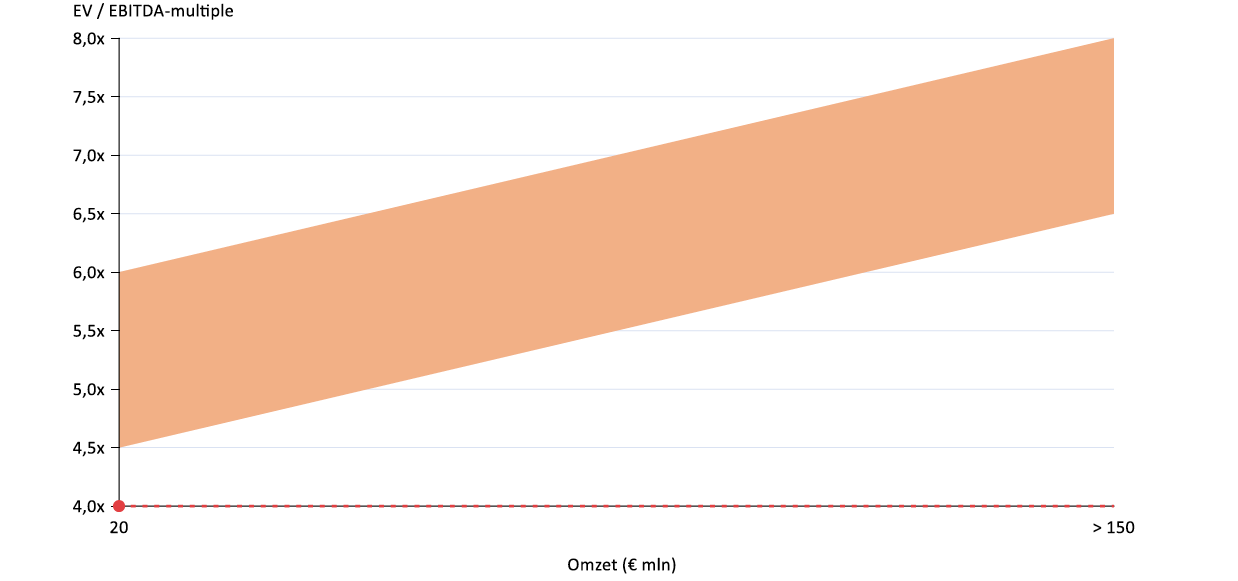

EV/EBITDA multiple range

Source: JBR analysis

The EV/EBITDA multiple range is based on an analysis of companies within the installation engineering sector and on recent transactions and developments within the market, based on available data

![]()