News

Dutch greenhouse horticulture faces major challenges due to rising gas price

Since mid-2021, the Netherlands has faced skyrocketing energy prices, which have substantially affected greenhouse horticulture in particular.

High gas price has major impact on greenhouse farming

Since mid-2021, the Netherlands has faced an explosively rising energy price, which is substantially affecting greenhouse horticulture in particular. The rising gas price is the result of a wide range of both structural and temporary causes.

For example, much less gas was extracted from the U.S., and because of the mild summer in 2021, less wind energy was generated in the Netherlands. In addition, Dutch gas supplies were exceptionally low last winter. The sanctions against Russia will also raise energy prices for a long time. Furthermore, there is an incredibly high demand for gas in the world and especially also in Asia, due to economic recovery after the initial COVID-19 wave.

Dutch growers have also been affected by COVID-19; ornamental horticulture and hospitality suppliers par excellence. Energy is about one-fifth to one-fourth of the total costs incurred by growers. The high price of energy can leave horticulturists facing impossible tasks: continue to grow crops and possibly make a loss, or not grow crops and sell contracts or lose customers.

In addition, the increase in gas prices also affects other components of the cultivation chain, such as the cost of fertilizer, packaging materials and transportation. Growers with variable supply contracts are suffering particularly badly from high gas prices. Often part of the energy is purchased on a variable basis and part is purchased at a fixed price. In addition, there are market gardeners who purchase all of their energy at a fixed price or all of their energy at a variable rate. It is expected that ultimately, horticulturists with fixed contracts will also suffer from energy prices.

Our analysis shows that it is likely that within the next 5 years, a substantial proportion of greenhouse growers are at risk of losing profitability due to the increase in the cost of energy: net income is at risk of becoming negative and solvency may fall sharply. This could lead to continuity problems.

Future net income and solvency of greenhouse growers

To examine the consequences of rising energy costs for greenhouse horticulture, JBR estimated the future net profit and solvency of greenhouse horticulturists. The analysis shows that a substantial proportion of greenhouse horticulturists are at risk of losing their profitability within the next five years due to the rise in energy costs: the average net result is at risk of becoming negative and solvency may fall sharply. Basis for the estimate are the average financial results and balance sheet figures 2017 - 2020 of greenhouse horticulture companies from Agrimation (2020, Wageningen University and Research) and assumptions on development scenarios of energy costs, operating income, and depreciation costs.

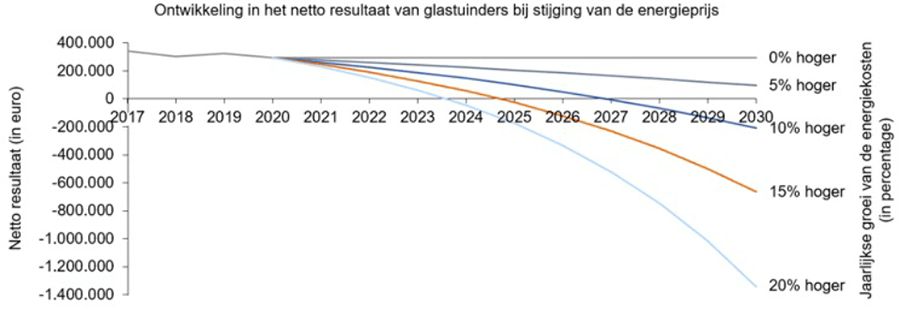

Figure 1 shows the development of net income for an average greenhouse farm under scenarios with different average annual growth rates of energy costs. In this estimate, operating income and all other costs are held constant over the forecast period.

Figure 1: The net result of greenhouse growers from 2017 to 2026 when gas prices rise

If gardeners' sales remain the same, and energy costs will increase by 15% annually, it is plausible that the net result will be negative in 2026 (see also Table 1). In this estimate, depreciation costs and all other costs are held constant over the forecast period.

Table 1: Equal turnover of gardeners and a 15% increase in energy costs results in a net negative result in 2026

In addition to the increase in energy costs, horticulturists today are expected to increase sustainability and take steps toward energy transition. Increasing depreciation costs due to investments in sustainability put further pressure on future net income (see also Table 2). This estimate holds operating income and all other costs constant over the forecast period.

Data from Agrimation show that already about 28% of all greenhouse farms have solvency below 50% and about 17% have solvency below 35%.

We expect with rising energy costs that the entire sector will fall below 50%. Combined with rising depreciation costs, on average, equity will become negative for a significant portion of greenhouse horticulture companies. Given the circumstances, horticulturists have little financial room to invest in the energy transition. This could further reduce their solvency which could lead to continuity issues.

Transactions, investments and scale-up in greenhouse farming

Despite the volatility facing greenhouse horticulture, there is a positive climate for mergers and acquisitions. For example, there is a lot of international and private equity interest in covered cultivation and vertical farming. The Netherlands has traditionally been one of the leading countries in innovation and success in greenhouse horticulture, in which it is eager to take a stake. In addition, there is a lot of money at low interest rates available for investment. Economies of scale are an important consideration for mergers and acquisitions in greenhouse horticulture. In 2020, the number of acquisitions in greenhouse horticulture was higher than in the past 10 years, with 85 mergers and acquisitions. This is almost double the number of mergers and acquisitions in 2017: at that time there were a total of 45 mergers and acquisitions in greenhouse horticulture companies. A strong merger and acquisition climate developed in 2021 for suppliers and installers in particular. For example, Atrium Agri has taken an interest in several agri companies since 2019 with eight current collaborations, including with a focus on sustainable and innovative cultivation.

Structural causes of high gas price may be of permanent nature

It is likely that the price of gas will remain high for the foreseeable future. The scarcity of gas is expected to remain very high with the uncertain course of sanctions against Russia and the ongoing international conflict. Incidentally, taxes on gas consumption will also rise due to the increasing CO2 price, among other things. More sustainable energy solutions, such as the use of geothermal heat, may also incur costs because they are indirectly linked to the price of natural gas. To keep up with the energy transition, extensive investments will have to be made, and subsidies will decrease over the next few years. In addition, with rising interest rates, investments will become less attractive. Investments will also result in higher depreciation costs and therefore also weigh on operations and results. Due to international competition, the question is whether both the high energy price and the investment costs can be passed on to the end user.

JBR can work with horticulturists to formulate future-proof strategies

Temporary solutions by horticulturists include postponing (growing) crops and starting the season later. For some horticulturists, it will be more profitable to supply energy back to the grid than to use it themselves, resulting in empty greenhouses. In addition, horticulturists may switch to growing "cold" crops, i.e. crops that thrive under lower temperatures, such as cabbages and peppers.

Many horticulturists with less financial room for flexibility and low solvency, will have to adopt other strategies. Careful consideration must be given to where there is room in a business to finance energy transition, innovation and/or digitalization. To make horticulturists future-proof, new revenue models can be developed to grow sales and business operations can be restructured. Here scenario analyses and liquidity models can help. One of the outcomes of an internal and external analysis of a greenhouse horticulture company could be that it is more profitable to take knowledge abroad, and thus internationalize, where greenfield sustainable technology is most beneficial. Also, strategic partnerships can be identified and established so that risk is shared and investments are more sustainable. Finally, the analysis may show that it is more profitable to put the company on sale or grow it through acquisition.

Contact the team personally

Harold Brummelhuis

Principal

Merijn Veltkamp

Associate