News

The European Green Deal

The Green deal aims to address climate change and combat environmental degradation. The goal is for the EU to be the first climate neutral continent by:

- Reduce greenhouse gases to zero by 2050

- Economic growth but without resource depletion

- Not abandoning people or regions

An intermediate step is to already emit 55% less greenhouse gases by 2030 than in 1990 (the so-called Fit 55).

To achieve the targets, policies will be adjusted in the areas of environment, energy, transport and taxation. Furthermore, there are legally binding climate targets for all key sectors. This package includes:

- Targets to reduce emissions in various sectors

- Incentive carbon sinks

- An emissions trading system to cap emissions, price pollution and generate investment in transition

- Social support for citizens and small businesses

Member states can spend 100% of their revenue from emissions trading on climate and energy-related projects and the social dimension.

In 2024, the European Commission came up with a new climate target for 2040 with the goal of reducing net greenhouse gas emissions by 90% compared to 1990.

From 2035, all new cars and vans must be emission-free. In addition, carbon pricing will be broadened from 2024 and will also apply to the maritime sector.

Below we focus on the industrial plan for the Green Deal presented in 2023. The pillars of this plan are:

- Predictable and simplified regulatory framework

- Quick access to funding

- Improving skills

- Encourage open and fair trade for resilient supply chains.

To achieve all the targets, laws and regulations are needed in all EU countries. The most tangible and perhaps most important instrument is the EU Emissions Trading Scheme (ETS). In the ETS as it stands today, about 10,000 companies participate mainly in sectors such as heating and electricity production, energy-intensive industry (refineries, steel manufacturers, cement, glass and paper production) and commercial aviation (within the European Economic Area). The companies concerned must surrender one allowance for each ton of CO2 emissions. These allowances can be bought and traded.

Since 2005, the ETS has helped reduce emissions from energy companies and industry by 37%. In 2024, the new target for reduction of ETS emissions has been adjusted from minus 43% to minus 62% (compared to 2005). The new linear reduction factor is 4.3% from 2024 to 2027 and 4.4% from 2028 to 2030.

A disadvantage of the ETS is that too generous initial allocation of allowances can interfere with goal achievement. Criticism of the ETS is therefore mainly over-allocation, large profits for energy companies, price volatility and failure to meet targets.

In addition to the EU, the following countries have an ETS: Canada, China, Japan, New Zealand, South Korea, Switzerland and the USA.

Incidentally, the ETS was chosen because it provides more certainty of meeting targets than "carbon tax. Moreover, there is a ceiling in the trading system, so there is greater certainty in achieving targets. Also, participating companies that cannot deliver allowances are fined EUR 100 per ton of CO2.

Participating companies must monitor and report their emissions annually. The reports must be verified by an accredited verifier. They must have sufficient allowances as of April 30 of the calendar year to cover their emissions for the following year.

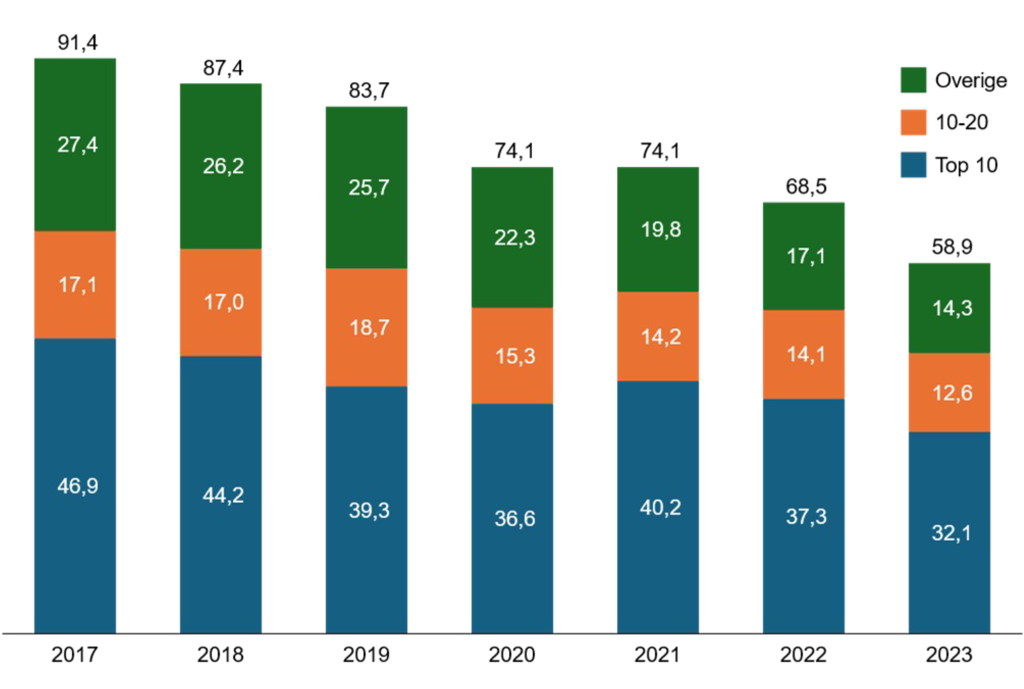

To put into perspective, the 10 largest plants in the Netherlands collectively produce more than 30 million tons of Co2 on an annual basis, according to the Dutch Emissions Authority. A clear downward trend is visible and if this continues the targets will be achievable.

Emissions in the Netherlands (emissions in million tons of Co2)

Source: Netherlands Emissions Authority (NEa)

Contact the team personally

Would you like to spar with one of our experts? We are ready to talk with you.

Ronald van Rijn

Managing Partner JBR

Rogier Tigchelaar

Senior Consultant Corporate Finance

Frank Steenhuisen

Associate