Whitepaper

Healthcare mergers and acquisitions

The increased focus on health care has also led to increased M&A dynamics.

View the JBR Healthcare Collaboration Monitor 2024, the most complete overview of mergers and acquisitions/participations in the Dutch healthcare sector.

Healthcare Monitor 2024 - Report of healthcare mergers and acquisitions

The JBR Healthcare Monitor 2024 contains the most complete overview of mergers and acquisitions / participations in the Dutch healthcare sector.

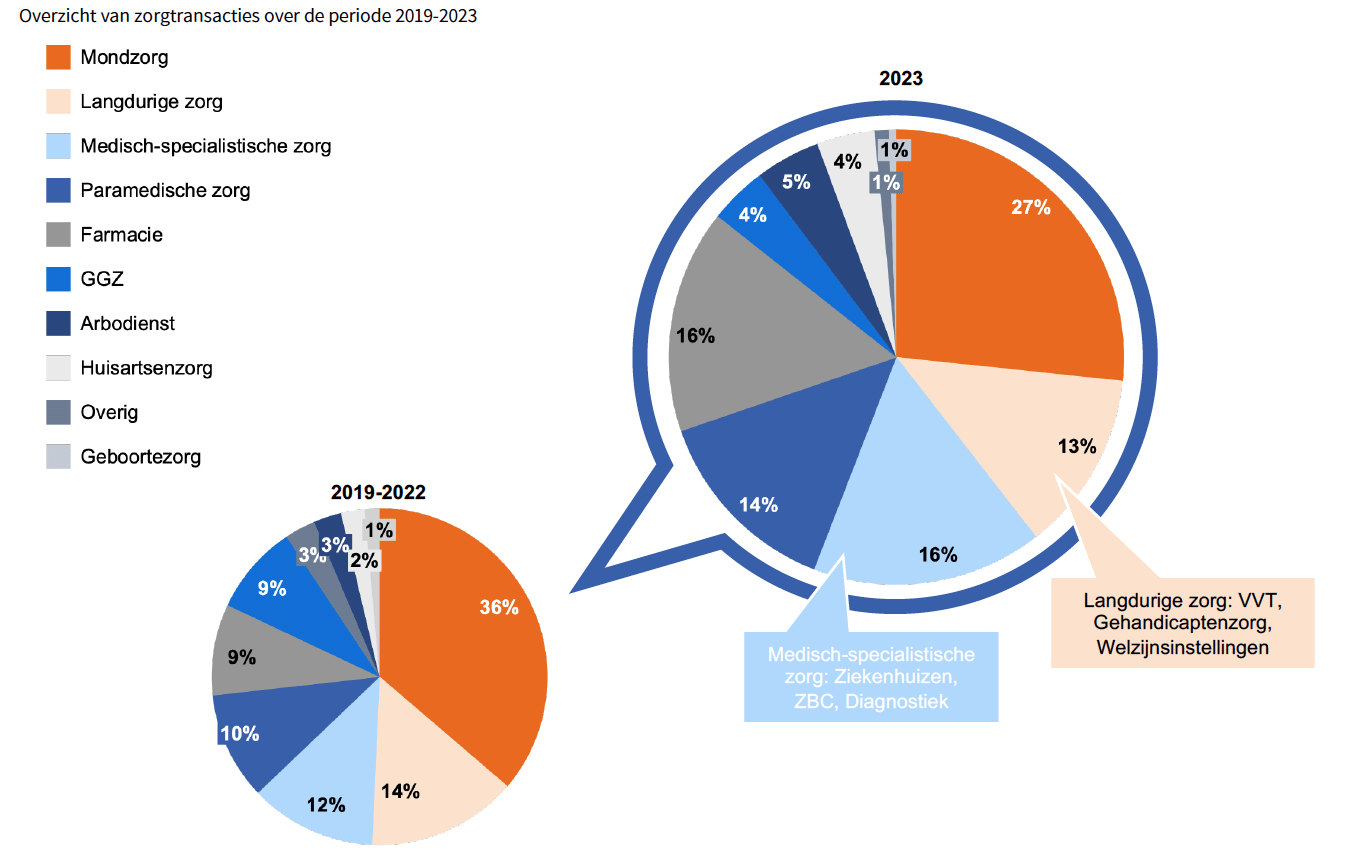

This report provides insight into 901 Dutch healthcare transactions during the 2019-2023 period.

It lists all acquisitions reported to the regulator, the Dutch Healthcare Authority (NZa), in the period 2019-2023. We then figured out which party is ultimately behind the transaction. Some 350 cases (half) involve private equity.

By adding sub-segments and scoring on additional criteria, this overview provides more insight (down to each individual transaction) than other overviews and publications.

Since 2010, JBR has been meticulously tracking results and providing them to healthcare facilities, administrators, supervisors and healthcare employees.

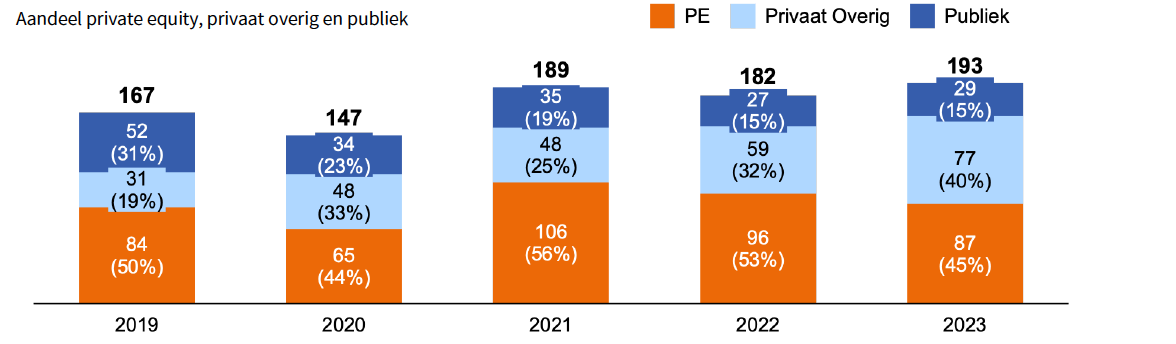

85% of transactions in 2023 were driven by private capital, with a decline in the share of private equity and an increase in other private investors.

The share of private equity continued to decrease after 2022 and the share of private other continues to increase. The 2023 Healthcare Monitor expected both private equity and private other to further dominate the Dutch healthcare transaction market, but it is now mainly the other private investors (mostly strategists) that dominate.

Alternative partnerships are on the rise and are increasingly a counterpart to the platform companies of private equity parties; these are mostly strategic collaborations that fall under private other. Some examples are discussed in the report.

Do you have questions about:

Collaborations, mergers or acquisitions that are or may be occurring at your organization, such as;

- Expansion or downsizing of your portfolio of healthcare activities;

- A complete list of all healthcare transactions analyzed;

- consulting activities of JBR in the healthcare sector and what JBR can do for you;

Contact the team personally

Caspar van der Geest

Partner

Thomas van Amerongen

Senior Consultant Corporate Finance

Suut Tang

Associate