Interview

The M&A dynamics in healthcare

The increased focus on health care has also led to increased M&A dynamics.

Read the complete interview with Caspar van de Geest.

Without trust, no deal!

Caspar van der Geest's motto is "Without trust, no deal! He has over 15 years of experience in M&A transactions in the Healthcare sector. As of 2020, JBR has assisted 14 sale and purchase transactions in the healthcare sector.

Recently, the team published the Healthcare Cooperation Monitor. It contains the most complete overview of mergers and acquisitions/participations in the Dutch healthcare sector over the years. Since 2012, JBR has meticulously maintained the monitor and provides it to healthcare institutions, executives, supervisors and employees in the healthcare sector.

We speak with Caspar about transactions, trends and developments.

You and your team researched the transactions of the past 4 years in the health care industry.

What is the overall conclusion?

"After the dip in 2020, a strong recovery occurred in 2021. You could argue that the pandemic caused a slowdown in the beginning and then actually accelerated. The increased focus on healthcare has also led to increased M&A momentum.

Where private equity in oral care was the rule rather than the exception, you see the increase of PE in the other healthcare segments as well. In transactions subject to the NZA healthcare merger test, the share of PE overall is around 60%. The share in the other segments excluding oral care has increased from 17% in 2018 to above 40% in 2021.

Some leading transactions are, of course, the sale of Bergman Clinics to Triton and the sale of Equipe Zorgbedrijven to Nordic Capital. But the entry of foreign parties into the Dutch healthcare market started earlier. These include not only PE, but also large strategists and listed institutions such as Korian, Orpea and DomusVi. These parties are mainly active in nursing home care and in recent years have bought several residential care companies such as Stepping Stones, Compartijn and Martha Flora.

The corona pandemic has also brought increased attention to mental health care. There is a consolidation going on within the mental health sector, triggered in particular by Mentally Better. In that segment I also expect a lot of dynamics in the coming years, although the emphasis is also increasingly on innovative care concepts and digitalization. With that, the focus is shifting from classic providers to newcomers offering e-health solutions and actually looking for a market."

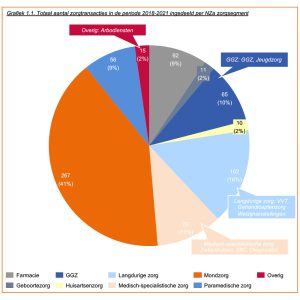

Total number of healthcare transactions categorized by NZa healthcare segment. Click on image for readability

What trends and developments affect transactions?

"The trend of aging manifests itself in many forms. Labor market shortages is one example. The healthcare sector is also facing structural shortages. The promise that e-health can meet the increased demand has not yet been fulfilled and at best only partially compensates. We are only at the beginning of the aging wave when it comes to the demand for care. A large group will turn 75+ in the next few years, and with that the demand for care will increase accordingly. Living at home longer is the trend, but due to the size of the elderly group and increased illnesses such as dementia, the demand for new residential care concepts and nursing home care is also increasing.

Providers that offer innovative solutions in these segments that increase efficiency and quality of care can expect considerable interest from an M&A perspective.

Digitization of care pathways is currently done by many small parties. Many transactions in this segment remain off the radar of the NZA because these parties are often not subject to reporting requirements. In this corner, I expect more M&A dynamics in the coming years. This also applies to ICT providers in healthcare."

Is there a specific segment(s) in which there were many transactions?

"Oral care has been the segment with the largest number of transactions for years. Also in 2021, this segment was clearly the largest with 89 transactions out of a total number of 213. Followed by long-term care with 32 transactions. And medical specialist care and mental health care, both with 22 transactions in 2021. Within inpatient care, I expect a lower number of transactions in the coming years. Partly because several larger private providers have already joined a strategist, and partly because some large strategists have taken a pass in terms of acquisitions."

Are healthcare transactions about consolidation?

And are there other reasons/values (softer ones) for a transaction?

"The drivers behind M&A activity are diverse and differ by segment. Volume aggregation and economies of scale are relevant in every segment. A central fixed-cost platform that becomes more efficient by adding more volume. Unfortunately, this promise is not always realized.

Smaller organizations struggle to remain independent due to increased regulatory pressure and tighter purchasing criteria from health insurers, care offices and municipalities. Joining a larger party then often offers a solution.

Also at play are the reasons as mentioned above, such as digitalization and the classic reason such as reaching retirement age for healthcare entrepreneurs."

Can you tell something about the forecast for the next 3 (or 5) years?

What transactions has JBR done in healthcare in recent years that fit the trends?

"JBR has executed several transactions in most healthcare segments in recent years and has been involved in the strategic growth or contraction agenda of public and private healthcare providers.

JBR boasts at least 15 years of healthcare experience. Various developments repeatedly stimulated new dynamics in the market, such as:

- The transition of domestic help to the WMO

- the introduction of ZBCs

- the redesign of the AWBZ

- Shifting third-line and second-line care to the lines below it

- new funding rules for e-health

- mental health care reform, etc.

Examples of these pathways are:

- sales of various healthcare providers and healthcare suppliers

- multi-year acquisition assistance with a large foreign healthcare provider

- restructuring of a VVT and WMO organization

- portfolio issues and strategy guidance for public and private healthcare providers

- For a complete overview, see: jbr.co.uk/references.

Can you say that the internationalization of healthcare is in full swing?

"In many countries around us, international consolidation had already taken place earlier. In recent years, the Netherlands has been increasingly in the picture with international private equity and large strategists. For example, the largest ZBC (Bergman Clinics) and the largest private GGZ provider (Mentaal Beter) have come into foreign hands. The largest child care organization, after a period of foreign shareholding with Onex, is back in Dutch hands (Waterland Private Equity). The question, by the way, is whether that really makes a difference.

I do not expect the internationalization of the healthcare market to decline in the coming years.

In fact, the innovative strength in the Netherlands also provides opportunities for rolling out abroad new concepts developed here. Therefore, I expect that attention will increasingly shift to providers of innovative care concepts such as digitized care pathways, telehealth and monitoring, diagnostics, etc. Classic providers that primarily have a lot of care capacity to offer will still be in demand. Although I think the heyday will weaken after this year's uncertain start with rising inflation, high absenteeism and increasing pressure on payer and financeability. All the more reason to set a clear strategic course precisely in these times, whether or not translated into a concrete M&A agenda."

Can you talk more about the JBR Healthcare sector survey?

"The Healthcare Cooperation Monitor contains the most complete overview of mergers, acquisitions and participations in the Dutch healthcare sector. By adding sub-segments and scoring on additional criteria, this overview offers more insight (down to each individual transaction) than other overviews and publications.

Since 2010, JBR has been meticulously tracking results and providing them to healthcare facilities, administrators, supervisors and healthcare employees.

The starting point for the research report are the healthcare transactions announced by healthcare institutions and approved by the NZa (Dutch Healthcare Authority)."

Do you have questions about:

Collaborations, mergers or acquisitions that are or may be occurring at your organization, such as;

- Expansion or downsizing of your portfolio of healthcare activities;

- A complete list of all healthcare transactions analyzed;

- consulting activities of JBR in the healthcare sector and what JBR can do for you;

Contact the team personally

Caspar van der Geest

Partner