news

Our customers have a blind trust in us

Interview in Brookz: 'As colleagues we catch each other's eye, there is a lot of sparring among ourselves and in addition we hold the closing dinners for our clients here at the office as well'

Read more

"The role of restructuring management is crucial; determination, tenacity, creativity and the ability to be able to negotiate a new deal with various stakeholders."

Article from Consultancy.co.uk

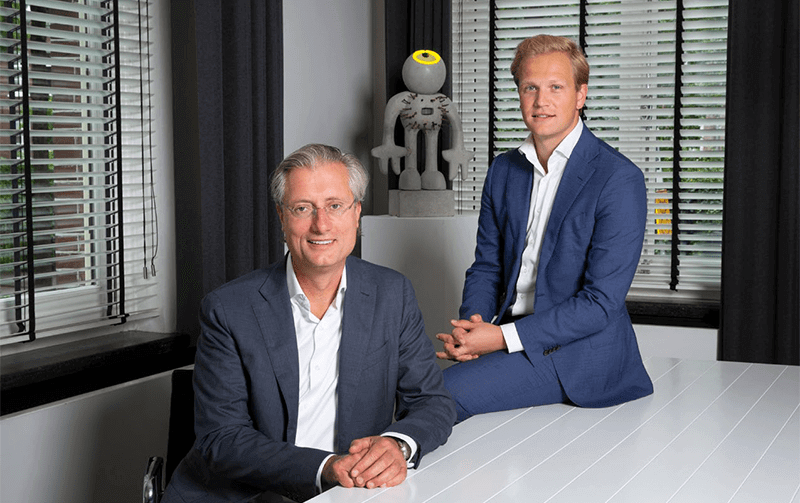

With the second corona wave sweeping the country, more and more companies have water on their lips. However, a continuity problem does not have to mean the end of the business. JBR helps companies that need to restructure to survive. Managing Partner Ronald van Rijn of JBR Consultancy and Bart Kroon of JBR Interim Executives talk about the business doctor's profession.

People - and especially entrepreneurs - often cherish the idea that they have everything under control. That reality is different became painfully clear to many this year. "The success of a company stands or falls with external and internal environmental factors," said Ronald van Rijn. "For a variety of reasons, companies can run into financial difficulties. Increasing competition or sudden drop in demand, all these factors can lead to a lack of liquidity and mounting losses. In this era of Covid-19, the problems usually arise from external factors."

You have no control over these external factors, but that does not mean that you are powerless. It is essential to dare to look in time at the things that are within your sphere of influence.

"The first step is joint recognition that there is a possible continuity problem," Van Rijn explains. "It is then a matter of quickly looking for the cause and the extent of the problem. In addition, we must gain insight into the activities that can be the cork to give the company a future perspective. Redesigning the business and changing its focus often offers a possible solution to avoid discontinuity."

When outlining a possible future outlook, corona does currently create additional uncertainty. Van Rijn: "At this time, it is important to determine the impact of Covid-19 and take into account different scenarios."

Once the diagnosis is made, the rescue plan can begin. In doing so, the first priority is almost always to improve cash-generating capacity, explains Bart Kroon: "Improving cash flow improves the organization's perspective in all aspects: short- and long-term financeability, financial independence, agility, reliability, investment capacity, profitability, stability and resilience. In situations of 'distress,' only a structural improvement in cash-generating capacity makes structural refinancing possible."

He explains that restoring cash generating capacity is often a combination of discipline, smart and consistent working capital management, creativity in contract management and maximum exploitation of financing relationships: "Think, for example, of tighter management and collection of debt, shortening billing intervals and renegotiating debt and terms with financiers."

"My personal experience is that in a restructuring setting much more is possible than is considered possible by stakeholders during the 'normal course of business,'" Kroon indicates. "The role of restructuring management is crucial here; boldness, tenacity, creativity and the ability to be able to negotiate a new deal with various stakeholders."

Once cash flow is in order, a longer-term view can be taken. In doing so, it is essential to scrutinize the sustainability of the business model. "Business models become jaded over time, and special circumstances can render business models ineffective in the short term," Kroon explains. "In a restructuring, the key is to focus on the essence of a company's value creation, recalibrate it and transform it to that recalibrated model."

This may involve looking at a variety of factors - from revenue, fee, margin and cost to customer orientations, product-market combinations, distribution models and more. It may also mean saying goodbye to those activities, values, assets and relationships that have no or limited value in the future. "Just like in the garage at your home; over time, a cacophony of stuff accumulates that it's better to say goodbye to," said Kroon, who immediately acknowledges that this is not easy: "Saying goodbye, in terms of divesting, selling, liquidating or closing is often a difficult process."

Partly because such difficult decisions must be made during a restructuring, Van Rijn and Kroon say it is essential to bring the right specialists on board. "Through years of experience with these restructuring issues, we quickly see through the situation," Van Rijn said. "The profession compares well to a doctor. The more often you have operated, the faster you recognize special situations. You can work more efficiently and with a high degree of success."

"It's often very emotional, because the necessary choices affect people and businesses."

"The role of the Chief Restructuring Officer is that of director and the decision maker," Kroon adds. "Ultimately he/she determines the direction, the pace and also takes responsibility for the sacrifices that have to be made for long-term continuity. Where possible/necessary you include stakeholders in such a transformation but sometimes there is no room for that, then 'being able to read the stakeholder context well' is an important skill. Long-term continuity is a virtual principal here. Not an easy role, a very rewarding role by the way."

However, Van Rijn emphasizes that not everyone is suitable for this role: "After all, not everyone can become a trauma doctor or work in a trauma team. It's make or break! We often work under time pressure, especially at the start. These are not casual assignments, it matters. It is often very emotional, because the necessary choices affect people and business."

Seasoned

JBR's consultancy practice focuses on the entire restructuring process - from quick scan to strategic analysis and advice. Once the restructuring is completed, the company can usually continue under its own steam, but sometimes there is still a need for a temporary director. Even then JBR can help, from its Interim Executives practice.

"JBR Interim Executives has a permanent team of seasoned interim directors," says Van Rijn. "They support each other through shadow management and knowledge sharing. An interim director helps implement changes to ensure continuity. He or she brings clarity, calm and stability. Determines priorities and mobilizes all forces to get the company back on track inside."

In conclusion, Van Rijn makes one more comparison with medicine: "If the doctor grabs a textbook first, then you can doubt his competence! The same applies to our team. We have an enormous amount of experience which allows us to quickly oversee the situation and intervene. The goal is the continuity of the business."

Ronald van Rijn

Managing Partner JBR