Interview with consultancy.co.uk

Influence of private equity in Dutch healthcare continues to grow

It has been a recurring theme in recent years: the advance of private equity in healthcare. JBR examined this in more detail in its healthcare monitor. More than half of recent acquisitions are attributable to private equity.

For its analysis, JBR mapped all transactions approved and published by the NZa. The analysis shows that after a contraction in the number of healthcare transactions in 2020 (caused by the Covid-19 pandemic), the number of transactions over the past two years reached more than 175 per year - more than the long-term average of 167 transactions per year.

The ratio of cure to care transactions remained roughly the same from last year, with oral care remaining the largest segment within care, followed by medical and specialty care, as it was last year.

Private equity

It has been a recurring theme in recent years: the advance of private equity in healthcare. JBR examined this more closely in its healthcare monitor. More than half of recent acquisitions are attributable to private equity, which was also the case last year.

If the oral care segment is removed from the dataset, however, a slightly different picture emerges. The share of private equity within this segment is so high that oral care boosts the overall percentage in the entire healthcare sector by 12 percentage points. In other words, excluding oral care, the share of private equity in the number of healthcare transactions is "only" 46%.

But private equity is also clearly on the rise in other segments: four years ago, private equity was involved in less than a third (29%) of transactions, so this year it is already heading toward half.

This increase comes mainly from the medical-specialty care, paramedical care, primary care and long-term care segments.

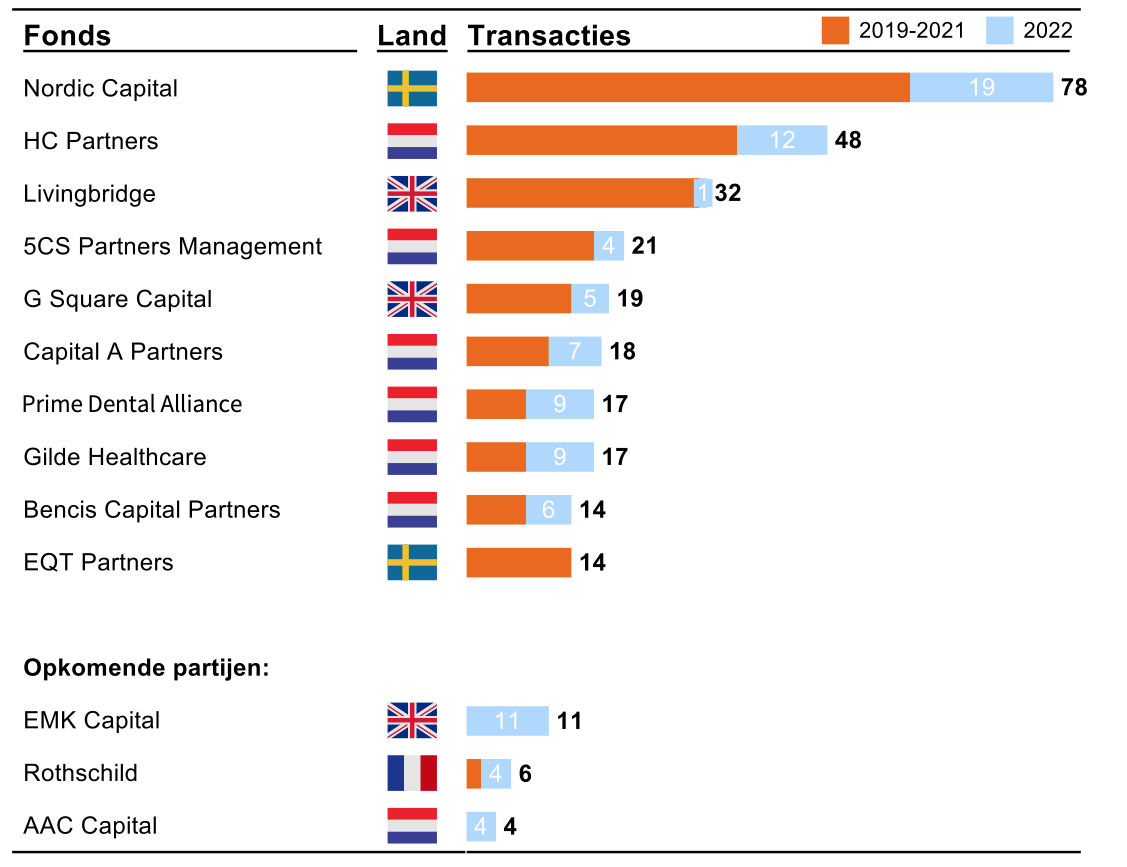

The best known example is Sweden's Nordic Capital, with portfolio companies such as Top Mondzorg (Dental Clinics), Equipe and Eyescan, followed by the Dutch HC Partners (formerly Harbour Capital Partners) as the most active investor in the segments. The private equity firm is mainly active within the physical therapy and oral care segments, through its platforms Physio Groep Nederland (FGN) and De Tandartsengroep.

Caspar van der Geest, partner at JBR, expects private equity - despite the slightly cooling deal market - to remain active in these segments. "We foresee further consolidation in specialist medical care, general practitioner care and long-term care. In addition, the trend of consolidation in oral care and paramedical care will continue."

Private equity firms often adopt a strategy in which they buy up smaller practices and assemble them from a buy-and-build strategy to create larger chains that can operate more efficiently. Larger size often also means better access to capital, which can be reflected in higher pricing for the company (known as multiple arbitrage).

Investors are mainly attracted to the healthcare sector because of the ever-increasing need for care, due to the aging population and the relative safety of healthcare investment (the sector is reasonably recession-proof). In addition, they see opportunities to professionalize the sector, including through digitalization and the introduction of technology.

Private equity's growing interest in the healthcare sector is a trend that can also be seen worldwide. A recent survey by Bain & Company found that investment firms put nearly $90 billion into the sector last year. This makes 2022 the second busiest acquisition year on record after outlier 2021.

And the end is not yet in sight, Van der Geest says. "I see this continuing for years to come, we're in the middle of it now. There is going to be another huge consolidation at independent clinics and laboratories, for example. And many practicing family physicians are retiring, cannot find a successor and so will (of necessity) choose to sell to a chain."

Read the also article in the Financial Dagblad: Private equity buys hundreds of healthcare providers, time for more (oversight)?

Source: Consultancy.co.uk

Do you have questions about:

Collaborations, mergers or acquisitions that are or may be occurring at your organization, such as;

- Expansion or downsizing of your portfolio of healthcare activities;

- A complete list of all healthcare transactions analyzed;

- consulting activities of JBR in the healthcare sector and what JBR can do for you;

Contact the team personally

Caspar van der Geest

Partner

Thomas van Amerongen

Senior Consultant Corporate Finance

Suut Tang

Associate

Merijn Veltkamp

Associate

Melvin Zandstra

Consultant Corporate Finance

Boudewijn van der Hart

Business Analyst

Sten Welboren

Business Analyst

Jelmer Haites

Business Analyst