Knowledge

Hydrogen and offshore wind

In recent years, there has been increasing attention to hydrogen, both in the Netherlands and Europe and abroad. Initially, hydrogen is applied in industry and mobility. Hydrogen is expected to play only a limited role in the built environment in the coming years.

Hydrogen

We can distinguish three types of hydrogen: gray, blue and green hydrogen. First, there is gray hydrogen. This is hydrogen extracted from natural gas or coal. Its production releases CO2, which is why we talk about gray hydrogen. Most of the hydrogen produced today is gray hydrogen. Second, there is blue hydrogen, in which natural gas or coal is also the raw material. However, the CO2 released during production is captured and stored. This makes blue hydrogen CO2 neutral. Finally, we speak of green hydrogen when it is made from renewable sources, such as solar or wind energy. In addition to being the most sustainable, green hydrogen is also the most expensive form of hydrogen. Currently, green hydrogen production constitutes about 1% of total hydrogen production.

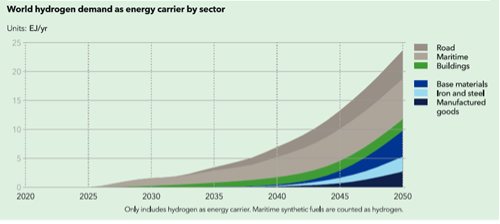

DNV expects hydrogen to contribute about 24 Exajoules (EJ) per year as an energy carrier by 2050. The main markets are maritime and transportation. Other sectors are expected to follow with some delay.

Climate Agreement

The climate agreement contains several goals about hydrogen deployment, including:

- By 2025, about 75,000 tons of hydrogen can be produced from water in the Netherlands. This will require an electrolysis capacity of 500 MW

- By 2030, electrolysis capacity is 3 to 4 GW and 300,000 cars are running on hydrogen

The central government is studying whether the current gas network can be used for hydrogen transportation in the future.

In early July 2021, the cross-sector working group on hydrogen proposed, among other things, the rapid scale-up of offshore renewable electricity production from wind, and in the future possibly from solar.

Offshore wind

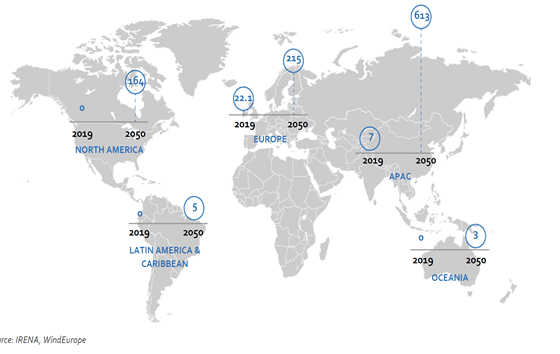

The offshore wind market is expected to grow strongly in the coming years; from about 29 GW of installed capacity in 2019 to more than 200 GW in 2030 and even about 1,000 GW of installed capacity in 2050. With this, offshore wind is expected to account for nearly 20% of total installed wind capacity.

Europe is the leader in offshore wind production. Asia is strongly emerging and will produce more offshore wind than Europe in the future, with potential offshore wind production of >600 GW in Asia versus >200 GW in Europe by 2050. In addition, much offshore wind capacity in North America is also anticipated. Europe and East Asia are also the regions where most hydrogen projects are planned.

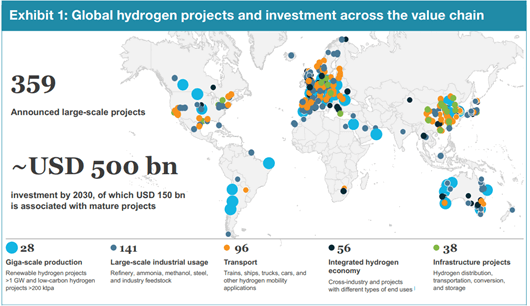

Capacity

As mentioned, proposed hydrogen projects are planned primarily in Europe and eastern Asia. In addition, there are initiatives in North America and Australia and, to a lesser extent, South America.

70% of the announced production capacity comes from renewable energy sources. The remaining 30% comes from low-carbon hydrogen generated from fossil fuels combined with carbon capture & storage (CCS).

Combined solar and wind power will be the main source of electricity for hydrogen production, followed by offshore wind and solar.

The European Union's ambition is to install 40 GW of electrolysis capacity by 2030 in the European Union and another 40 GW in North Africa.

Source: Hydrogen Council

An example of a new project combining offshore wind and hydrogen is NortH2, a consortium of Equinor, Gasunie, Groningen Seaports, RWE and Shell. It involves production of large-scale green hydrogen using offshore wind. NortH2's goal is to produce 4GW by 2030 and 10GW by 2040.

Future green hydrogen

Green hydrogen is expected to account for a larger share of total hydrogen produced in the future. The ability to be cost competitive is currently the main challenge for green hydrogen.

Among other things, location and size of the project will determine the price, as will the price of electricity. In addition, the speed at which governments shape the energy transition is important to the pace of adaptation of green hydrogen. At some point, economies of scale and cost reductions in renewable energy and electrolysis will make green hydrogen more competitive.