news

M&A in the Dutch installation sector

Read the JBR Installation Market Monitor, a concise and informative overview of mergers and acquisitions in the Dutch installation sector.

Read more

Read consultancy.com's article on the mega task of climate transition, talent scarcity and acquisition activity in the installation industry.

The mega task of climate transition and the scarcity of talent are generating considerably more acquisition activity in the installation sector. This trend is expected to continue in the coming years, according to JBR research.

The mega task of climate transition and the scarcity of talent are generating considerably more acquisition activity in the installation sector. This trend is expected to continue in the coming years, according to JBR research.

The installation sector plays an important role in realizing the government's sustainable ambitions. Making buildings sustainable is a major factor in this, both for utility and residential construction.

The installation sector contributes to this through the construction, installation and maintenance of ventilation, heating and cooling systems. These include heat pumps, heat recovery systems and climate control. In addition, increasing electrification and related grid issues are creating a new segment of installation work for energy storage systems, such as hydrogen storage, battery systems and geothermal heating.

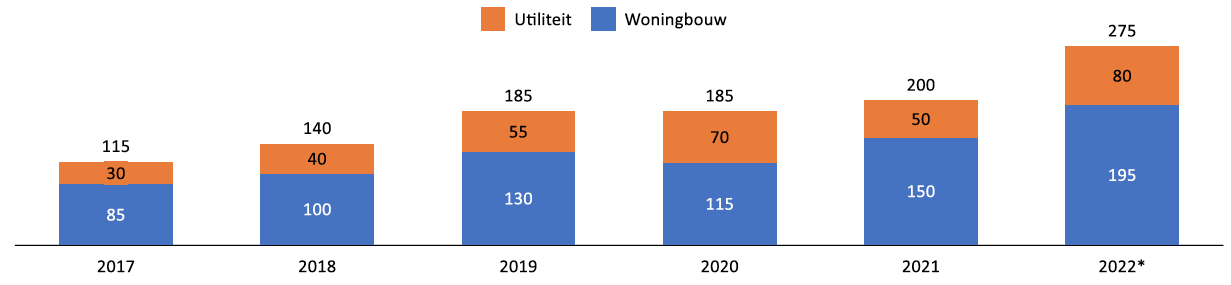

Number of mergers and acquisitions in the installation market

Source: CBS StatLine

For both non-residential and residential construction, the installation sector has seen strong market growth in recent years, according to JBR's Installation Market Monitor 2023. This has also seen a significant increase in the number of mergers and acquisitions, said Ronald van Rijn, managing partner at JBR. "The sector has shown an annual growth of about 19% in mergers and acquisitions since Covid-19."

"This trend is largely due to the structural demand for installation services arising from the development of sustainable technologies in various sectors," adds Rogier Tigchelaar (senior consultant at JBR).

Making buildings more sustainable is an important driver for a climate-neutral Netherlands. "We are making a huge transition toward energy-neutral homes," said Van Rijn. "This includes all kinds of initiatives, such as the heat transition (the transition from the use of natural gas to sustainable alternatives for heating), installation of solar panels and the use of smart energy management systems."

"This provides a lot of work for installers," says Van Rijn, who points out that the government's climate ambitions to make the Netherlands climate-neutral by 2050 at the latest ensure that this trend will certainly not end for the time being. "The climate ambitions are also supported by the uncertainty in the energy market," according to Van Rijn.

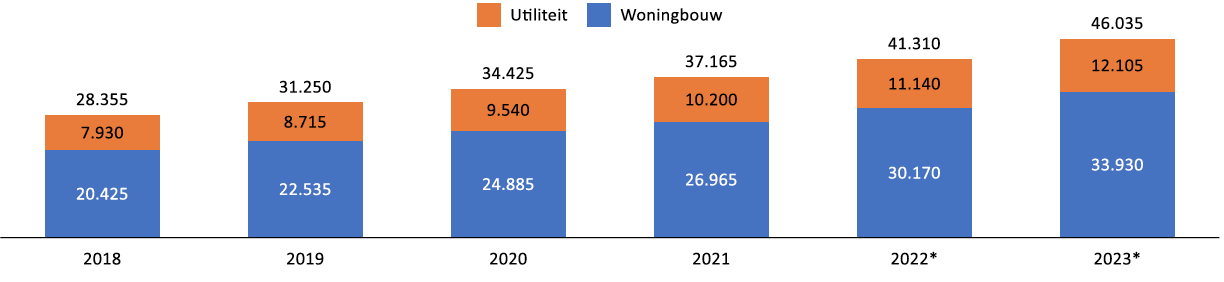

Number of companies in the installation market

Source: CBS StatLine

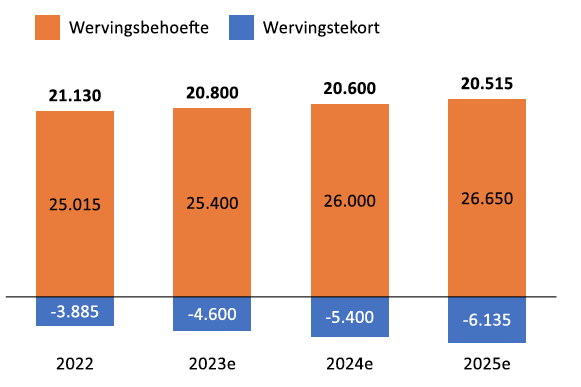

At the same time, installation companies see themselves facing several major challenges. At the top of the list is the shortage of technicians. Tigchelaar: "There is a particularly severe shortage of mechanics, who account for roughly 60% of the workforce in the installation labor market. In the coming years, the worker shortage will increase even further, on top of the already existing shortages."

To meet this challenge, the installation industry spends a lot of money on training programs, including retraining people from other sectors. But this is not enough and also takes a lot of time. In addition, developments in new installation solutions require increasingly specialized knowledge of mechanics.

To still bring in the hands they need in the shorter term, companies often venture down the acquisition path. "Buying up industry peers in order to bring in their employees is a common strategy in today's market."

Labor market tightness (in number per year)

Source: KBA Nijmegen & Wij-Techniek

However, the acquisition path offers more advantages. In many acquisitions, strategic expansion is the main driver. "Through targeted acquisitions, parties can expand their portfolio and strengthen their position in the market," Van Rijn said. "Strategic acquisitions allow them to acquire new technologies and expertise, achieve cost synergies, increase their customer base and operating area, and gain access to new markets."

Additional scale can also contribute to further professionalization and greater efficiency in operations, including in back-office processes such as finance, sales, ICT, HR and legal. Work scheduling can also be optimized and knowledge sharing and expertise will receive a boost. Furthermore, the increase in purchasing volumes ensures better conditions at wholesalers and importers.

These economies of scale also relate to that other major headache facing installation companies today: high inflation. Says Tigchelaar, "Entrepreneurs within the construction and installation industry are experiencing challenges due to rising procurement costs. The prices of wood, steel and plastic, among others, have risen considerably in recent years, and the same is now happening with energy-intensive materials such as concrete, bricks and cement."

All in all, these developments are creating a very attractive landscape for mergers and acquisitions. Not surprisingly, private equity is beginning to stir more and more. JBR notes that private equity firms are becoming increasingly active within the installation industry, regularly financing the buy-and-build strategies of installation companies. This trend, in turn, is stirring up independent installers, who feel it is on or off.

This trend, in turn, is stirring up independent installers, who feel it's on or off. "Together, this results in the merger and acquisition market we are currently seeing," Van Rijn said. "Characterized by increasing activity, a picture that is moreover structural in nature."

Source: Consultancy.co.uk

Ronald van Rijn

Managing Partner JBR

Rogier Tigchelaar

Senior Consultant Corporate Finance

Rik Van Meirhaeghe

Managing Partner JBR Belux

Jelmer Haites

Business Analyst

Alexander Rutten

Business Analyst